Looking for your next employee?

Leave the resourcing to us.

If you've got a digital role to fill, look no further than Digital Skills.

With a global skills shortage and demand for digital experts on the rise, competition to recruit and secure digital talent is tougher than ever.

As a result, you might find filling your next specialist vacancy could end up taking longer than you hoped or planned.

However, despite these challenging times, there is a way of simplifying the recruitment process to get the people you need.

Work with Digital Skills and you will have access to our unique network of digital professionals - some of whom are already in the market for their next opportunity and would be interested in what you have to offer.

Network of experts

Through maintaining long-term connections with specialists from a broad range of technical disciplines, we can let you know who is looking for their next challenge and match them to the job you have in hand.

No more advertising for applicants.

Less time sifting through CVs.

With Digital Skills, resourcing has never been easier - despite the competitive landscape we find ourselves in.

Contact Digital Skills

Got an up and coming role you need filled?

Looking for a hard to find expert?

Then drop Digital Skills a line today.

We'll make light work out of finding - and hiring - the people you need so you can get your digital transformation strategy off to the right start faster.

Download Area

Are you a hiring company or contractor worried about IR35 law? Download our handy check sheets to make sure you stay compliant.

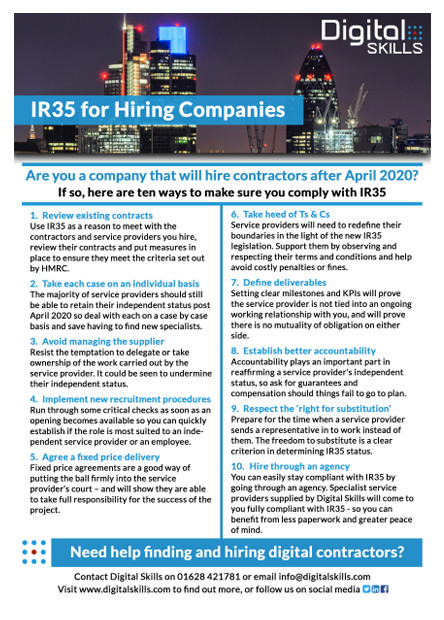

IR35 for hiring companies

IR35 legislation shifts the responsibility for determining whether a freelance contractor is really an independent or a part-time employee to the company that hire them. If inside IR35, the hiring company will be obliged to deduct income tax and national insurance from fees paid. Find out what you can do to prepare for the onset of IR35 and download our tick-sheet.

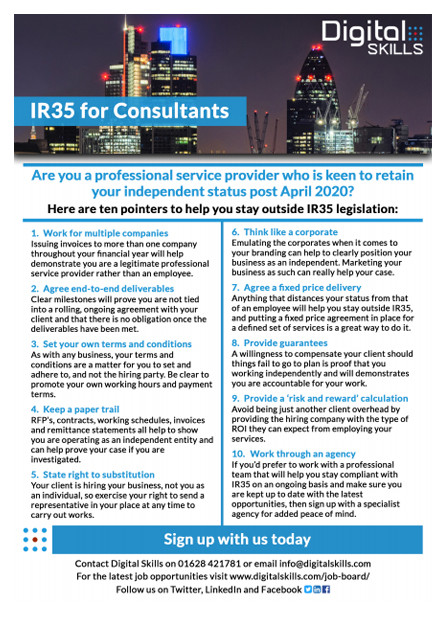

IR35 for Contractors

If you are a freelance consultant, then the onset of IR35 might fill you with dread. However, with the right advice defining whether you are in or out of IR35 does not have to be complicated.

For some quick pointers, download our free to access PDF.