Caught up in IR35 paperwork?

Leave the headaches to us.

If you need temporary staff but are concerned about IR35, then you've come to the right place.

Digital Skills works with business owners, hiring managers and HR professionals to relieve the stresses and strains of IR35.

From checking independent contracts to sorting out payroll and service agreements, we'll take the heavy lifting off your hands by making sure all of the specialists and experts we send to you are fully compliant, lawful and ready for the job in hand.

Safe pair of hands

We work to best practice and will never look to bend the rules or risk your compliance by working around legislation.

By staying on top of employment law, we stay informed so that we can guide you through the complex process of recruitment in the IR35 age so you end up with all the people you need - without any of the headaches.

Case by case basis

With Digital Skills there's no need to take sweeping action in an attempt to stay compliant. We can help you stick by your best contractors and also find you the new talent you're looking for by helping you determine the IR35 status of every person you hire.

By reviewing your recruitment requirements, we can quickly identify whether your service providers reside either inside our outside of IR35 legislation, and then advise you on how to on-board them so you end up with the talent you need.

The result is that your business and your teams are all compliant with IR35 - and have the paper-trail and processes in place to prove it.

Business as usual

Looking to get that complicated digital transformation project off the ground? Need to fill a role due to absence or maternity?

Contact Digital Skills today.

As your recruitment partner of choice, we can help you with your hiring requirements and put your IR35 compliance concerns to rest.

Download Area

Whether you're a hiring company or a contractor, download our handy check sheets to make sure you stay compliant.

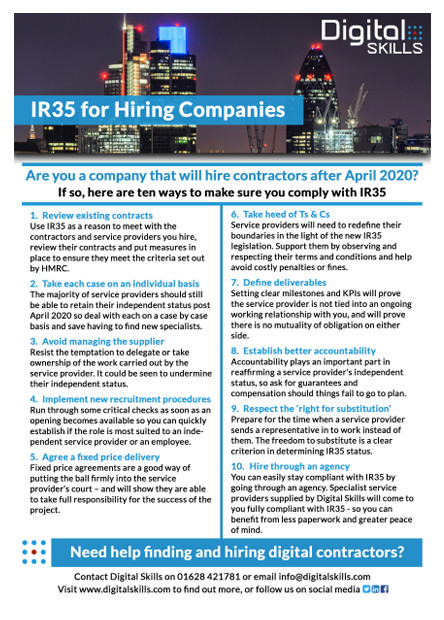

IR35 for hiring companies

IR35 legislation shifts the responsibility for determining whether a freelance contractor is really an independent or a part-time employee to the company that hire them.

If you want to make sure the people you hire are outside IR35, then work through the checklist below to make sure you stay compliant.

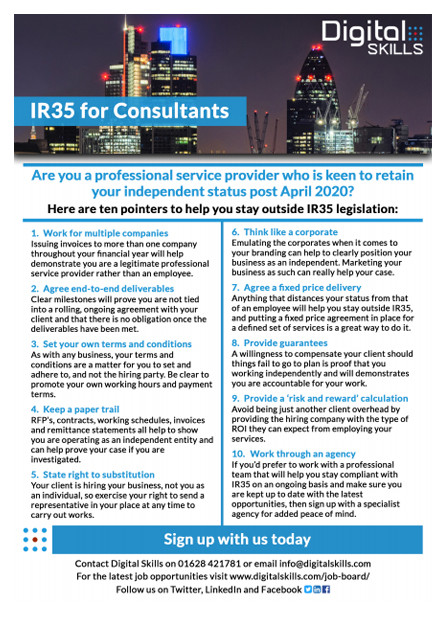

IR35 for Contractors

If you are a freelance consultant, then the onset of IR35 might fill you with dread. However, with the right advice defining whether you are in or out of IR35 does not have to be complicated.

For some quick pointers, download our free to access PDF.